Share Market: Your Friend for Financial Freedom

Lots of people around us who are currently working in an organization as an employee wants to earn more to have a better and secure financial future. For this, they either work overtime and do freelancing or start part-time employment. This may give them extra bucks for spending, but at the expense of their spare time.

If they could save this time, they would either spend it with their loved ones or on the things they love to indulge in. We all have to admit that this precious time is what we miss during our days of employment. We miss long holidays with our family, we miss extended weekends with our friends, we miss our recreational activities but most of all, our mind is always occupied with the thoughts of financial security in the future. Ultimately, it impacts our work performance at our primary source of employment. This somehow restricts us to excel even in the future, in comparison to our fellow employees who are fully dedicated to their one and only source of employment.

So, is there a solution to every so-called problem stated above? How does one enjoy her/his time at her/his prime days of active life and again have financial freedom in the future? The answer lies in a quote by the most famous physicist, Albert Einstein. He once famously said, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t, pays it”. Since we are concentrating on financial freedom, we would rather focus on the earning part rather than the paying part of it. We would further discuss on how this particular compound interest would eventually help us to worry less and enjoy more while achieving our financial freedom in the future.

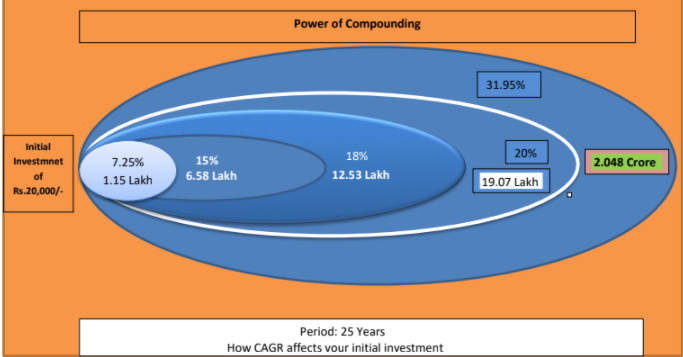

For those of our friends who are not so much into mathematics, let’s start with a simple illustration. What would be the amount if we double Rs. 20,000 ten times? No, my friend, it is not Rs. 200,000 but mind-boggling Rs. 20,480,000 because double of Rs. 20,000 is Rs. 40,000, that of Rs. 40,000 is Rs. 80,000 and so on for 10 times finally doubling to Rs. 20,480,000. Similarly, even if we double an amount as less as Rs.2,000 for 10 times it would result to a decent Rs. 2,048,000. Looking at our spending habits we can easily assume Rs. 2,000 to be our monthly spending on tea and coffee when we are employed. Now, what has this to do with Compound Interest would be our immediate question? In the world of money-making and finance, we take the compound interest as a tool to double your amount. The financial world likes to call it a compound annual growth rate (CAGR). So, the CAGR determines how fast your money is going to get doubled while other things remain constant. Let’s further illustrate this with the following figure:

Here, as per the illustrations, for Rs. 20,000 to become Rs. 20,480,000 by doubling 10 times takes a CAGR of 31.95% every year for 25 years. But 25 years is an awful lot of time. However an average working period of us Nepalese is 20 to 25 years before we get into retirement. Here, with this very application of compound interest, you can enjoy various facets of your life while on employment by just investing a small fraction of your annual income without worrying about future financial security. In fact you will be very rich by the time you retire.

Now the other big question arises, how do we gain the annual growth rate in 20 and 30 percentiles when the average annual FD (Fixed Deposit) returns is fluctuating around 7% to 13% in the recent times? Our retirement plans in majority of times don’t provide us with these kinds of return. We cannot even have ownership of land or start a company, if the employment allows, with such a small amount in case we assume they provide the required rate of return. So, how?

The answers lie in the share market of our economy. Majority of the companies in existence for 25 years or more with their launch in the share market have provided their shareholders a CAGR of more than 20% in Nepal. Even better some of these traded companies in our share market, NEPSE (Nepal Stock Exchange), particularly in the BFIs (Banking and Financial Institution) segment have surpassed our expectation of 31.95% by several percentages. You can always verify my claims with the published capital of companies 25 years back and that of now subject to market price adjustments.

Now that you have finally decided to start investing in the share market with the very concept, do not worry my friend about being wrong few times. This is because you won’t just invest once but multiple times throughout the years before you retire. Even if a few of your investments go sour, the rest would make you very rich taking you closer to your financial freedom. It is just like planting a seed of a mango tree. The seed is cheap and would take time to become a massive tree. However, once it turns into a fully grown tree, returns are humongous compared to the cost of that particular seed. However, here we are not just talking about planting a tree but a garden full of them.

Happy Investing!!

– Astitwa Sharma

(The writer is an investor in the capital markets of Nepal since a decade with exposure to Indian Capital Markets. You can reach out to him via twitter: www.twitter.com/@DGywali )

प्रतिक्रिया