Negative Interest Rate to make you Rich in this Stock Market

Let’s suppose your weight here on the planet earth is 75 kg. Let’s also presume that you become the first person to travel to the moon commercially for a holiday. After landing there, you feel very light and decide to weigh yourself. Fortunately, you have a weighing machine with you. Wow!! to your surprise, you are 12.40 kg ( according to the lunar weight calculator). So, the big question is, has anything changed except for you travelling from earth to the moon? Yes, and the answer is gravity.

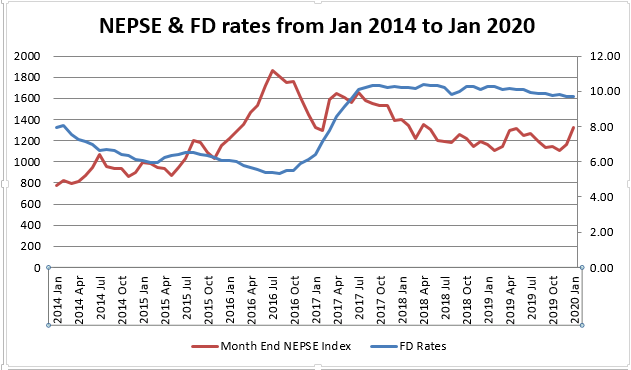

Likewise in the investment world, what gravity does to our weight the interest rate does to the investment decisions. Talking about stock market as a form of investment facilitator we can say higher the interest rate, higher the gravity, lower the stock price and vice-versa. Further explaining, if you get a 7% fixed deposit interest rate and the average return of a particular company in the stock market is 10% you would turn towards stock market for investment. Not only you but a lot more people would be turning to the stock market because of the same reason creating a huge demand over the present supply. As we all know increase in demand means increase in the price if that particular product is in limited supply, as a result of which the price goes high. The same working mechanism applies to the overall stock market as well. Let’s see how the fixed deposit (FD) interest rate for individuals has affected the overall stock market performance, NEPSE Index, in the recent years:

As we can see in the above graphical representation, the interest rate and the NEPSE index are inversely related to each other. While preparing the data for this graph, we had taken the interest rates archives from Nepal Rastra Bank (NRB) for personal fixed deposits and for NEPSE index, we had taken the average data from various secondary sources including NEPSE’s website for every end of the month stated above. The index went to its all-time high crossing 1880 mark when the average fixed deposit interest rate was hovering around 5.34% p.a. and the lowest of the index in the recent history of around 1100 points was when the average rate was around 10.29% p.a.

Taking about the present-day situation as well, we see a lot of positive momentum in the market due to the Covid-19 effects. It has downsized activities in the economy resulting in less loan mobilization from the banks. This, in turn, is resulting in negative pressure in the interest rates creating a surge in demand for alternative investments to the depositors.

This forms a solid base that the market conditions in terms of prices are going to go up if the level of economic activities remains constant or falls even further. This is not because the fundamentals of the companies/stocks, except for few companies and industries, have changed but because the participants in the economy are in search of other sources of returns.

Now, taking about where this money will eventually flow in our stock market, we have to go through the shift in investment communities’ thinking. Throughout the world, due to this health crisis, the investors, be it short-term or long-term, are in a search of safety nets rather than wealth creators. They are investing in the companies which are going to survive the crisis or at least they think will survive this crisis. Any company whose existence and growth is heavily dependent on brick-and-mortar system of business operations are more prone to this health emergency than that of digital platforms. In the digital platforms, there are less human interactions and they mostly run on an automated system relying less on humans. As a result of which the companies in the digital platform have seen a surge in demand of their stocks, increasing their company’s valuation by several times. We can take examples such that of Alphabet (Google), Facebook, Amazon, Apple, Reliance Industries (mainly due to its Jio platform) and many others. They also take a greater weightage in their respective indices resulting in the overall upward trend of the index.

However, in a market system like ours, there are few sectors to look after while searching for safety nets. As the economic activities are slowing down day by day, the financial system is unfortunately shrinking. This suggests us to a lesser return from this sector in the near future. If we certainly knew when this crisis was to end we would have known the impacts in the financial sector including the banking sector which occupies the major share in our capital market. Talking about other major parts of the financial system and the capital market, growth of the insurance sector be it life or non-life depends upon the capacity of the individuals and businesses to produce income. As this crisis has been downsizing the income levels, we eventually may see many defaults in premium payments.

The other sector in our share market is the manufacturing companies which due to the ongoing shutdowns and lockdowns throughout the country are seeing their sales downsized as well. Although being essentials producer, the need of human interaction has limited their production and sales volume. Similarly the hotel sector, the trading sector and listed sectors in other categories are facing their share of trouble due to the crisis. The revival again would be heavily dependent upon the healthcare system up-gradation and people being confident so as to move towards their new normal life with Covid-19. The other solution, which is more permanent in nature, would be the vaccine.

If everything remains the same as it is right now and not worsen, the only sector left here to invest would be the hydropower sector. Not saying completely safe to the ongoing crisis but comparatively less hit due to its reliance in the government as its customer, being one of the essential commodities for day to day life and having an obligation to ensure not only its property but also the loss-of-sales, the sector would be a better option as a safety net. Even the government has been supportive to this sector for continuing its construction, production and maintenance during the current crisis. However due to the lack of strong regulatory authority in this sector, not all companies are investors-friendly. We must take this into consideration as well while investing. The other reason for this sector’s better performance in this condition is the interest rate in itself. The decreased interest rate is an unwanted financial event to the depositors but a favorable one to those with loans. As we know the hydropower sector is a capital intensive industry, negativity in the interest rates simply means positivity in the form of the reduced cost of production and the increase in operational profits.

As per the recent report of NRB (https://www.nrb.org.np/contents/uploads/2020/07/FSR-2018-19.pdf) , a total of NPR 2,659,3910,000 has been invested as a credit to electricity, gas and water sector. A majority of which has been used for furthering the hydropower production in the economy. Simply put, even 1 % decrease in the interest rate would create NPR 265,939,100 liquidity in this PPA (Power Purchase Agreement) finalized sector. This, one way or the other, comes to the investor’s benefit. When the participants of the market realize it, they will eventually turn to this sector till the situation comes back to normal again. This is how the Nepalese investors could create their own safety nets and possibly create their alpha in this crisis followed by falling interest rates.

Happy Investing!!

-Astitwa Sharma

(You can reach out to the writer on his Twitter handle: https://twitter.com/DGywali )

Disclaimer: The view presented in this article are that of the writer, and not of the publisher. This content is for educational purpose and is not a trading recommendation. The investors are advised to do their own research before investing.

प्रतिक्रिया